Save Money on Your Car Insurance

If you think you’re paying too much for your insurance, you’re not the only one. Car insurance is expensive, but it doesn’t have to cost you an arm and a leg. Consider making these five changes to save money on this necessary expense.

Your Provider:

The best way to save money on your insurance is to compare quotes before settling on a provider. Different insurers will offer different prices and plans for the same driver, so the first deal you find might not be the best. It isn’t hard to do the research since there are many sites that will help you compare multiple car insurance quotes online. In addition, insurers change their premiums frequently, so it’s in your best interest to compare quotes every year before you renew since the amazing deal you received last year might not be the best option out there anymore.

Your Payment Plan:

Did you know that one simple change to your payment plan could save you money? Many insurance providers offer a discount if you pay your premium in one lump sum at the beginning of the year, rather than in monthly installments. It’s a win-win for everyone involved – insurers save on the administration cost for monthly payments and have the security of receiving money upfront, and you have the opportunity to pay less for the same coverage.

Your Coverage:

Not all insurance coverage is legally required, so you could save money by dropping parts of your plan – under the right circumstances. If you’re driving an older car, consider dropping collision coverage.

How do you know if it’s the right option? Determine how much you’re paying for collision coverage, and how much you’d pay as your deductible if you were to make a claim in the event of an accident. If you’ll be paying more for these costs than the value of your car, it might be better to drop your collision coverage and put that money into a savings account so you can buy a new car when the time comes.

Your Deductible:

In many cases, raising your deductible (the amount you agree to pay if you have to make a claim to your provider) will lower your premium payment. Sounds good, right? It is, but only if you have the extra cash on hand to manage the higher cost if you need to make a claim. One way to help cover the added expense is by setting up an emergency savings account with enough money to cover your deductible in the event that you need to make a claim.

Your Plan:

Signing up for a Usage-Based Insurance (UBI) plan could earn you significant savings. UBI refers to an insurance plan in which you track your driving habits (such as speed, braking, and distance driven) with a digital device that reports your driving behavior to your insurance provider. Most insurers who offer UBI give a small discount upfront just for signing up. And if your data shows you’re a safe driver? You could be eligible for up to 30 percent in savings when it’s time to renew!

Making just one of these changes to your car insurance coverage could start saving you money right now. And if it’s not time to renew your policy just yet, make sure you set a reminder to start comparing quotes a few months before it expires. The money you save on insurance could be better spent on things like taking a road trip this summer or saving up for your next car.

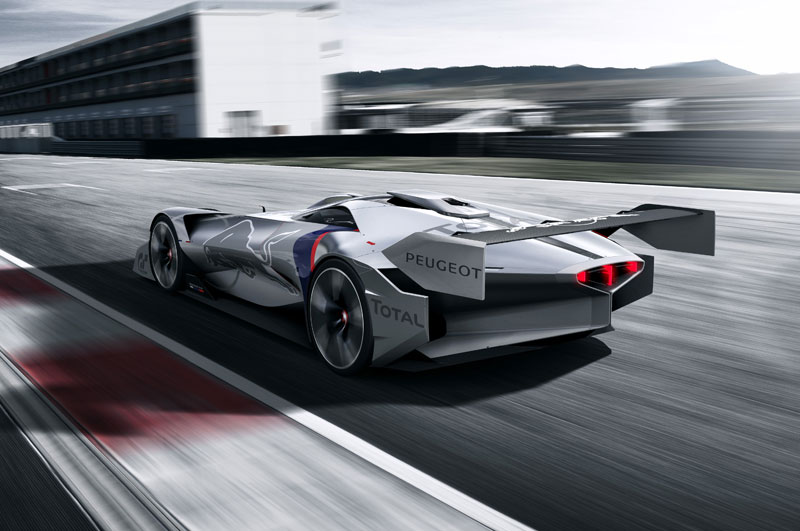

Featured image bycheap full coverage auto insurance