Purchasing Car Insurance For Less

Purchasing auto protection, home protection and finding a merchant to enable you in the process to can appear to be expensive and tedious. Be that as it may, in case you’re searching for any sort of protection including auto scope there are a means you can take to guarantee you get ideal reserve funds. Read on to discover how you can purchase protection and secure low rates for your scope.

Your initial phase in looking for protection, paying little mind to whether it’s for your auto, home or some other kind of scope is to search around. The web has made looking for accident protection less demanding than previously. You never again need to call singular organizations each one in turn. Or maybe, there are online sites that will give you a free online statement from numerous insurance agencies with one contribution of your own data. This will enable you to spare you both time and cash.

When you have your protection nothing says you can’t inquire in with your organization like clockwork for potential funds. For example, most collision protection organizations will give driver’s that have not gotten any infringement inside a specific time span a rebate on their protection strategies. Stay aware of your protection with the goal that you don’t pass up a major opportunity for any potential funds.

All through Canada, the law requires that individuals who drive vehicles have accident coverage. The rates charged protection relies upon various distinctive variables. For example, driving history, age, sex, area, where you stop your auto overnight and for what purposes you’ll be utilizing your auto all affect your protection premium rates.

Insurance agencies will take a gander at driving history keeping in mind the end goal to decide the probability you’ll be a mishap or get a driving infringement. On the off chance that you have a background marked by moving infringement or mischances your premiums will be higher on the grounds that you are to a greater extent a hazard for the insurance agency to cover. Age is likewise imperative. More youthful and more up to date drivers will have higher protection rates contrasted with their more seasoned partners.

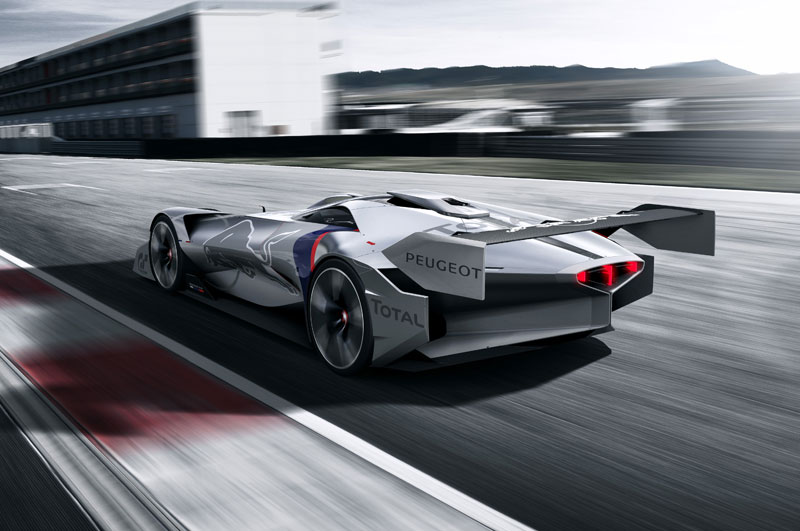

The sort of auto you drive will affect your protection rates too. A games auto will be more costly to guarantee that a family auto. Why? Just in light of the fact that individuals driving games vehicles will probably speed than the individuals who drive greater and more secure autos.

Every region all through Canada handles vehicle industry marginally in an unexpected way. For example, in a few territories protection is dealt with by the administration. In different regions, you’ll see that protection is taken care of by the private division. A few territories have a mixture show where both government and private parts are included with auto protection.

Auto protection can be obtained from various distinctive authorized scenes. Protection intermediaries are free protection suppliers. You can discover master exhortation that will enable you to decide your scope needs. Protection operators are like representatives however they offer approaches for the benefit of a specific organization. Having auto scope is required by law to defend shoppers against money related destroys if there should arise an occurrence of a mishap. While there are numerous favored protection bundles, in case you’re on a spending you can discover more rearranged scope that ensures you are withstanding the law while you are out and about.