Plenty of businesses rely on vehicles to do business.It is not just large companies either. Plenty of small businesses can become more competitive by adding a car to the fleet. Whether you need to transport customers, employees or goods, you may need to use this car every day. However, before purchasing or leasing such a vehicle, you need to ask yourself a few questions first. Here are some considerations to bear in mind before signing on the dotted line.

Should You Buy an Electric Car?

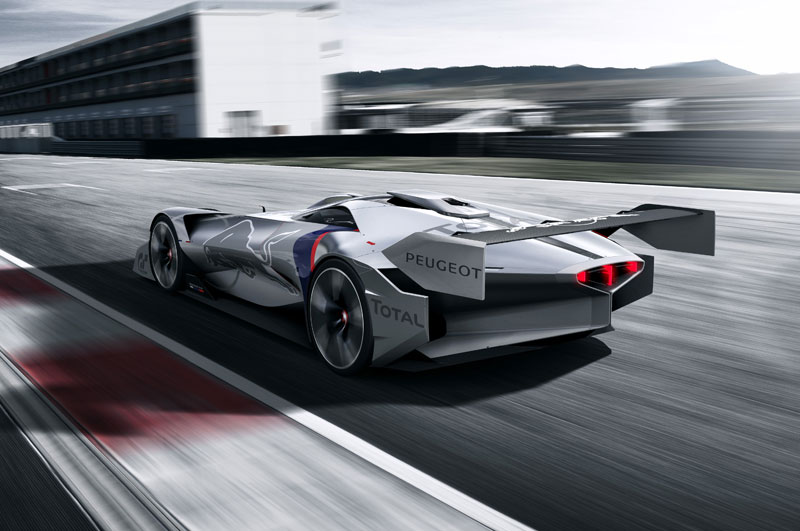

First, you need to think about how your car will benefit you in the future. While purchasing an electric car may be more expensive upfront, you will save money in the long run. In actuality, electric vehicles have become much more affordable in recent years. For example, you can buy a used Chevy Volt and get an excellent car for your business at a reasonable price.

Another factor to consider is the tax credits. The federal government offers tax credits to business owners who invest in hybrid cars. You should speak with your accountant first to see what kind of credits you can qualify for. You may need to buy a specific make and model of vehicle to get the best credit possible.

Should You Buy or Lease a New Car?

One reason why many business owners delay getting a car for their businesses is that it can be expensive. These days, the average price for anew small caris $20,000. Small businesses may not have enough money lying around to buy a car outright. After all, business owners have a lot of expenses, and at the end of the day, a car may be superfluous.

This is where leasing comes into play. You can get a more expensive car for your business, but you do not pay as much. That way you get the best car on the market at a price you can afford. Additionally, you can write off some of the cost of the lease on your taxes at the end of the year.

Do You Have an Older Vehicle You Can Trade In?

You may already have a company vehicle, and you can get a great deal when purchasing a new one if you can trade in the old one. Depreciation will come into effect, but you should look into saving money when you can.

Another option is to sell your old vehicle on your own to try to get more money that way. This naturally requires more work and effort on your end, but you could end up with thousands of more dollars. It is up to you what you want to do and whether you think selling independently is worth the effort.

Will You Be Able To Afford the Insurance?

When many business owners buy a new car, they only think about the monthly payments. They try to budget only that, which causes problems when additional expenses arise. One of the biggest expenses you will have for your new car is insurance.

It works in your best interest to look into insurance before buying a car. The reason for this is that your premiums will vary depending on the exact make and model car you buy. Paying insurance for two different cars could be the difference in paying hundreds of dollars annually.Getting a vehicle for your businessis expensive, so do not make it harder on yourself than it needs to be.

Your company’s operations can really benefit from a new car. As long as you pursue the purchasing or leasing process wisely, you will benefit for years to come. When in doubt, ask your employees for their opinions.